Know Your Limits: Maximizing Efficiency with HERE Technologies’ New Tool

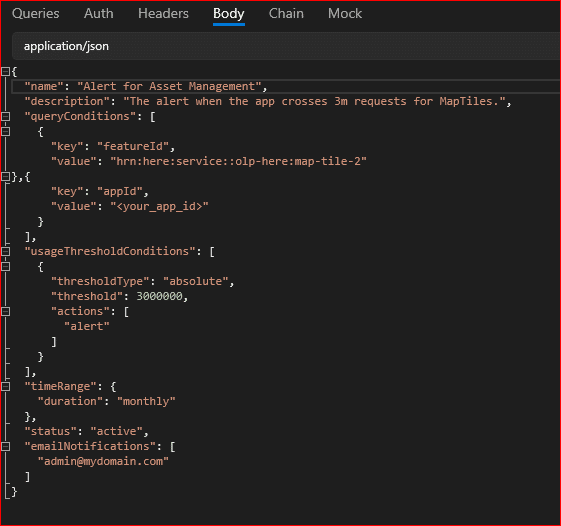

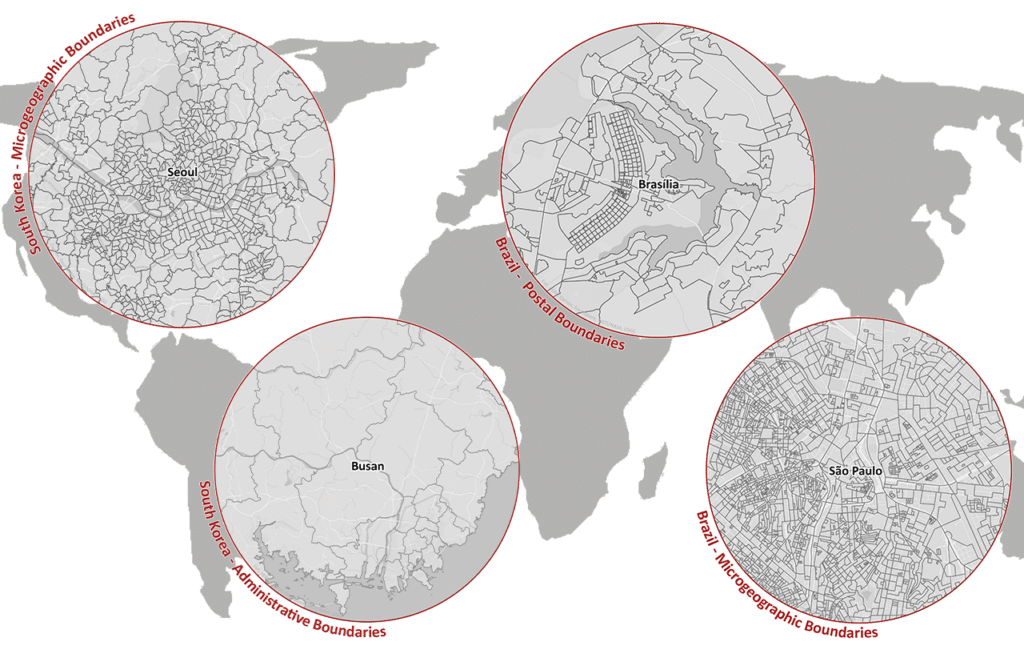

With the transition to the HERE Platform and the adjustment of some licensing models, there is now the opportunity to use the new HERE Usage Alert API as well as […]

With the transition to the HERE Platform and the adjustment of some licensing models, there is now the opportunity to use the new HERE Usage Alert API as well as […]

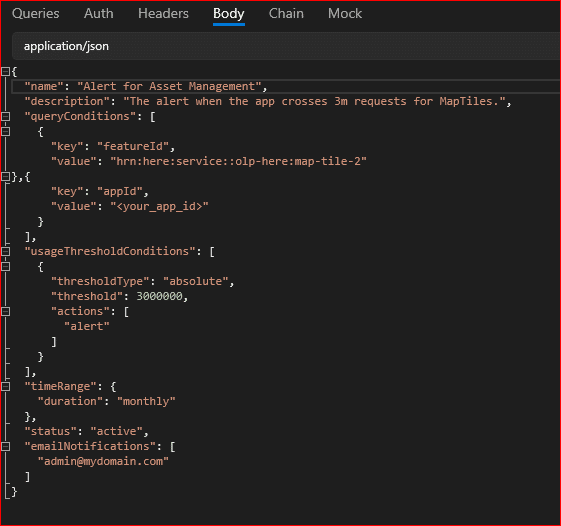

Based on the latest research from SWR, in the federal state of Baden-Württemberg in Germany, there is a concerning discrepancy between recommended and actual response times for ambulance services. Medical […]

Karlsruhe, May 08th 2024: Michael Bauer International (MBI), a leading provider of global geographic, market and risk data, proudly commemorates its 15th anniversary, celebrating a remarkable journey of innovation, growth, […]

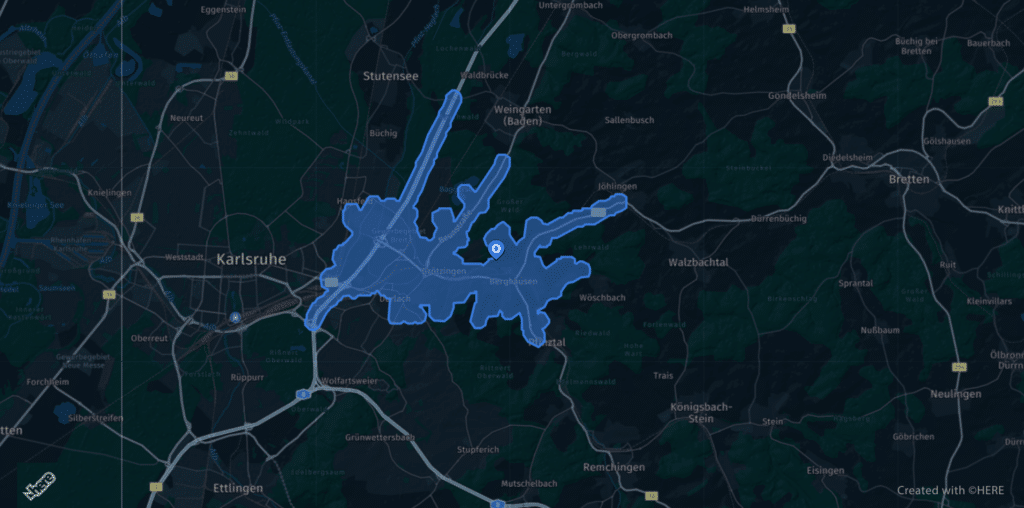

Karlsruhe, April 23rd 2024: Michael Bauer International (MBI), a leading provider of small-scale geodata, is pleased to announce the release of the latest edition of their administrative, postal, and microgeographic […]

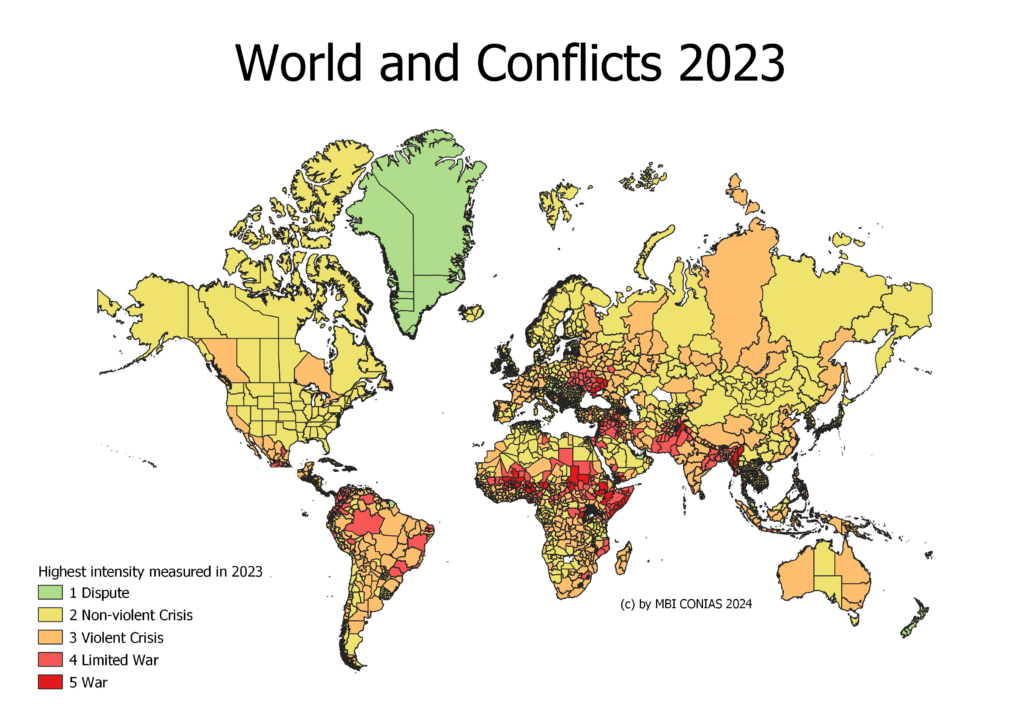

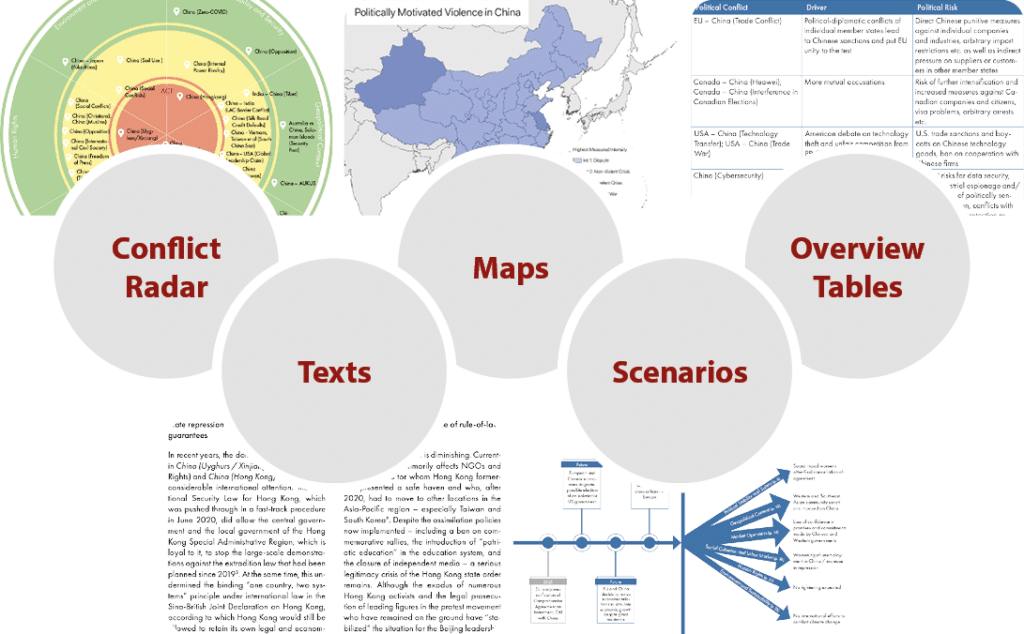

Karlsruhe, February 15, 2024: A world in disarray that can also be measured empirically. The CONIAS Risk Intelligence Team at Michael Bauer International (MBI), is monitoring almost 600 non-violent and […]

As businesses grapple with the challenges of an increasingly interconnected and volatile global landscape, Michael Bauer International (MBI), is pleased to announce the launch of its revolutionary product – the […]

As we embark on the promising journey that is 2024, it’s the perfect time to reflect on a year filled with exciting opportunities, invaluable industry insights, and the forging of […]

Our recent participation in the HERE Directions event in Prague was an unparalleled experience for our team. The event, hosted by our long-standing partner HERE Technologies, not only provided a […]

Karlsruhe, November 09th, 2023: Michael Bauer International (MBI) is proud to announce that it has been recognized as the Global HERE Distributor of the Year for 2023 by HERE Technologies, […]

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information