Consumer Styles

GLOBAL MARKET SEGMENTATION AND DETERMINATION OF TARGET GROUPS

WHAT ARE CONSUMER STYLES?

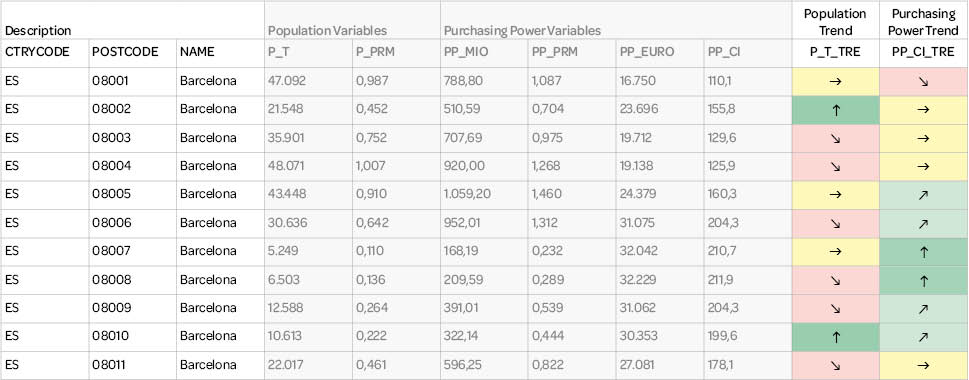

The data Global Consumer Styles is an innovative model for market segmentation and determination of target groups. Our segmentation approach has 10 internationally comparable consumer groups based on the characteristics of the population. It helps companies identify which consumer types are using their products and where these consumers are most likely to be found. This is an alternative to the socio-demographics and purchasing power as when collecting data for the consumer styles the key focus is on the people and their interests and lifestyles. This approach makes use of the principle that people with similar backgrounds and ages normally settle down in the same neighborhood. Consumer Styles are currently available for more than 50 countries in five continents.

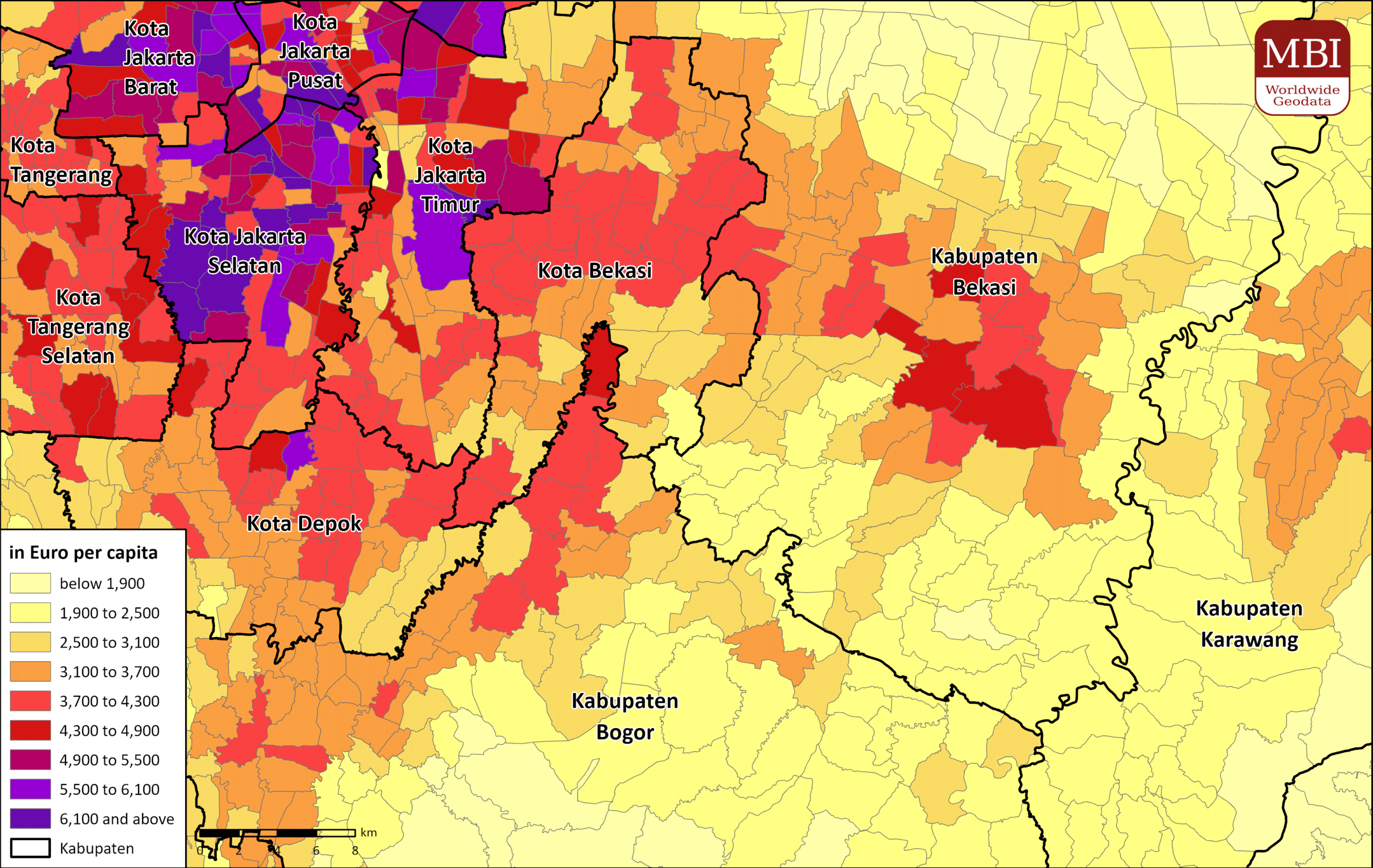

WHICH CONSUMER STYLES ARE MOST FREQUENT AND WHERE?

The data shows for these countries the most prominent Consumer Style within an area.

- Where do the Apple and Android-users live?

- Why do people drive a SAAB even though they could afford a Porsche?

- Who prefers to buy in a store instead of online shopping?

- Who only buys brand names?

- Where do people live who like buying sport products, clocks and jewelry?

- Who is interested in further education?

- Where do the leisure-oriented people live?

- Etc.

WHAT IS THE BASIS OF THE CONSUMER STYLES?

The data Global Consumer Styles is created by our experts on the basis of various segmenting criterions identified and validated in detail in extensive research on international level. The criterions include sociodemographics, value orientations, mindset, attitudes and motivations, consumer behavior and consumption volume.

The data are based on a representative global survey of around 16,000 consumers. The results were used to identify relatively homogeneous population groups with different characteristics and purchasing behavior.

These are condensed across countries into 10 different “Consumer Styles”. The result is a consistent and internationally comparable database for global market segmentation.

Consumer Styles are flexible and can be customized to suit specific customer requirements. For example, specific consumer brand preferences (e.g. preferred car brand) or even behavioral characteristics (e.g. social media consumption).

GLOBAL CONSUMER STYLES – 10 INTERNATIONALLY VALIDATED CONSUMER STYLES

Type A - High Earning Urban Professionals

Consumers in this segment show the highest per-capita income of all segments. They live almost all in single or multi-person households without children. They are employees, mainly in a managerial position or self-employed and have far above average or higher education. Regarding the willingness to spend for product groups such as clothing, this segment is a leader. They live mainly in metropolitan areas and large cities. Regarding smartphones, other than in most other segments, Apple is preferred to Samsung.

Type B - Comfortably Off Empty Nesters

The consumers in this segment are almost all in the second half of life and live in households without children. In shopping, they value quality and well-known brands. They also have favorite brands and shops and are able to keep track of a wide range of products and services offered; they prefer Brick and Mortar instead of online. Their per-capita income is significantly above average.

Type C - Modern and Pragmatic Over-50s

The consumers in this segment are predominantly in the second half of life and live in households without children. Environmental protection and innovation have a high priority. High value is set on careful purchase planning. Best value for money is systematically searched. The per-capita income in this segment is mostly well above average, whereas the per-household income is, due to the domination of one- or two-person households, mostly around or slightly below average.

Type D - Well Informed Modern Consumers

The consumers in this segment have significantly high expenditures in product groups like clocks and jewelry and sport products. They are able to keep track of a wide range of products and services offered. Online purchase is well above average. They are significantly above average white collar employees. Quality, innovation and environmental protection have a high priority. The majority has a well above average per-capita income.

Type E - Affluent Highly Educated Urban Families

The consumers in this segment have significantly high expenditures per households for practically all product groups. They are the segment with the highest online-shopping frequencies. They are employees, mainly in a managerial position and have far above average a higher education. They live predominantly in families with children and are mainly members of the younger age groups. They enjoy shopping and like new products. They live mainly in metropolitan areas and large cities. This segment shows the highest per-household income of all segments, but due to the number of children per household, the resulting per-capita income is less significantly above average. This segment has the highest percentage of smartphone-users and social online network usage. Regarding smartphones, other than in most other segments, Apple is preferred to Samsung.

The consumers in this segment have significantly high expenditures per households for practically all product groups. They are the segment with the highest online-shopping frequencies. They are employees, mainly in a managerial position and have far above average a higher education. They live predominantly in families with children and are mainly members of the younger age groups. They enjoy shopping and like new products. They live mainly in metropolitan areas and large cities. This segment shows the highest per-household income of all segments, but due to the number of children per household, the resulting per-capita income is less significantly above average. This segment has the highest percentage of smartphone-users and social online network usage. Regarding smartphones, other than in most other segments, Apple is preferred to Samsung.Type F - Security-oriented Seniors

The consumers in this segment are almost all in the second half of life and live mostly in households without children. They put emphasis on security, relationships with fellow men and self-respect. Share of retirees is the highest in this segment. They search for best value for money and have favorite brands and shops. The majority in this segment has an around average per-capita income.

Type G - Orientation Seeking Lower and Middle Class Consumers

Important values for the consumers in this segment are excitement, sense of belonging and social engagement. They are interested in new products but often find the quantity and quality of the many different products and the related product information confusing. The majority in this segment has a below average per capita income.

Type H - Younger Lower and Middle Class Consumers

The majority of consumers in this segment has a below average per-capita income. They are mainly members of the younger age-groups and almost all live in multi-person-households, mostly with children. Education and tradition are important to them. They enjoy shopping and look out for best value-for-money and favorite brands and shops. They put emphasis on security and self-respect.

The majority of consumers in this segment has a below average per-capita income. They are mainly members of the younger age-groups and almost all live in multi-person-households, mostly with children. Education and tradition are important to them. They enjoy shopping and look out for best value-for-money and favorite brands and shops. They put emphasis on security and self-respect.Type I - Modern Younger Families

The consumers in this segment live in multi-person-households, almost all with children. They are employees, mainly in a managerial position or self-employed. Due to the number of children per household, the per-capita income is below average but in terms of household income is above average. Excitement is important for them and they have well above average expenditures for certain product groups such as sport products and permanent education. Majority of them are in the early-family-phase. In shopping, they are very interested in new products and mostly buy well-known brands.

The consumers in this segment live in multi-person-households, almost all with children. They are employees, mainly in a managerial position or self-employed. Due to the number of children per household, the per-capita income is below average but in terms of household income is above average. Excitement is important for them and they have well above average expenditures for certain product groups such as sport products and permanent education. Majority of them are in the early-family-phase. In shopping, they are very interested in new products and mostly buy well-known brands.Type J - Low-Income Younger Consumers

The consumers in this segment have on average the lowest income compared to the other segments. Majority of them are teenagers or persons in their twenties. They are strongly characterized by a substantial absence from the labor market, being the segment with the highest shares of students, unemployed and housewives. They live often in rural areas or smaller cities.

The consumers in this segment have on average the lowest income compared to the other segments. Majority of them are teenagers or persons in their twenties. They are strongly characterized by a substantial absence from the labor market, being the segment with the highest shares of students, unemployed and housewives. They live often in rural areas or smaller cities.KEY DIFFERENTIATORS

Globally consistent and comparable data

Strict quality control

Individual consulting and support

Continuous updating

100 % GDPR compliant

COUNTRY AVAILABILITY

Europe | North America | South America | Asia | Oceania | Africa

DATA FORMATS

Tab delimited file (TXT) | KML | Access database (MDB) | Excel (xls) | Esri Shapefile (.shp) | Esri Geodatabase (.gdb) | MapInfo (.tab, .tabx) | MapInfo MIF/MID | GeoJSON | more on request

> LEARN MORE

TELL US WHERE YOU ARE HEADING.

WE WILL GLADLY ASSIST YOU IN SELECTING THE DATA NEEDED TO REACH YOUR GOAL.

Didn’t find what you are looking for or have another question? Please do not hesitate to contact us!

Our experts will be happy to advise you individually and without obligation on which data you can use to create added value for your company and realize savings.

Would you like to evaluate and visualize the data?